Good News for those with Chronic Conditions and a High Deductible Health Plan (HDHP)

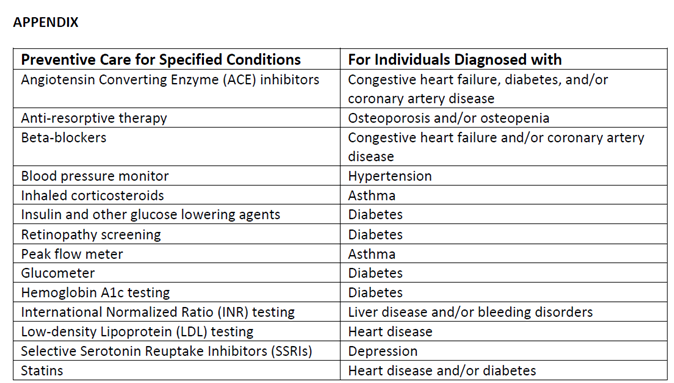

Earlier this month the IRS issued guidance – Notice 2019-45.pdf – expanding the list of preventive care for High Deductible Health Plans (HDHPs)*. According to the July 17, 2019 IRS News release “…certain medical care services received and items purchased, including prescription drugs, for certain chronic conditions should be classified as preventive care for someone with that chronic condition”. See the Appendix from Notice 2019-45 listing the type of care and chronic diagnosis.

The expanded list of preventive care from the appendix are permitted by the IRS to covered by the HDHP plan either without the deductible or a lower deductible than the qualified HDHP deductible. Historically, the majority of such treatment would have been subject to the annual deductible on a HDHP.

According to the CDC 6 in 10 adults have a chronic condition in the US and 4 in 10 adults have two or more. This change will save lives and money as it reduces the cost barriers to getting care for chronic conditions.

Vocabulary:

High Deductible Health Plans (HDHPs) – Medical plans designed by the IRS with specific parameters – and in turn given their stamp of approval to work with a Health Savings Account. Individuals enrolled in these types of plans may be eligible to contribute pre-tax dollars into a Health Savings Account (HSA).

Health Savings Account (HSA) – A tax favored account available to those enrolled in a HDHP. The money in this account is set aside to pay for qualified medical expenses (deductibles, coinsurance, Rx, dental and vision treatments see full list ).

- For 2019, if you have an HDHP, you can contribute up to $3,500 for self-only coverage and up to $7,000 for family coverage into an HSA.

- For 2020, if you have an HDHP, you can contribute up to $3,550 for self-only coverage and up to $7,100 for family coverage into an HSA.

- HSA funds roll over year to year if you don’t spend them. An HSA may earn interest or other earnings, which are not taxable.

#AholaBenefits #ahollotofinsurance #HSAs #HDHPs #Savethatmoney